COVID-19 & Its Impact on Everyday Life: May 15 – 18, 2020

Both concern with and the perceived trajectory about the pandemic continued to hold steady this week. There hasn’t been meaningful improvement in the perceived trajectory of COVID-19 since mid-April.

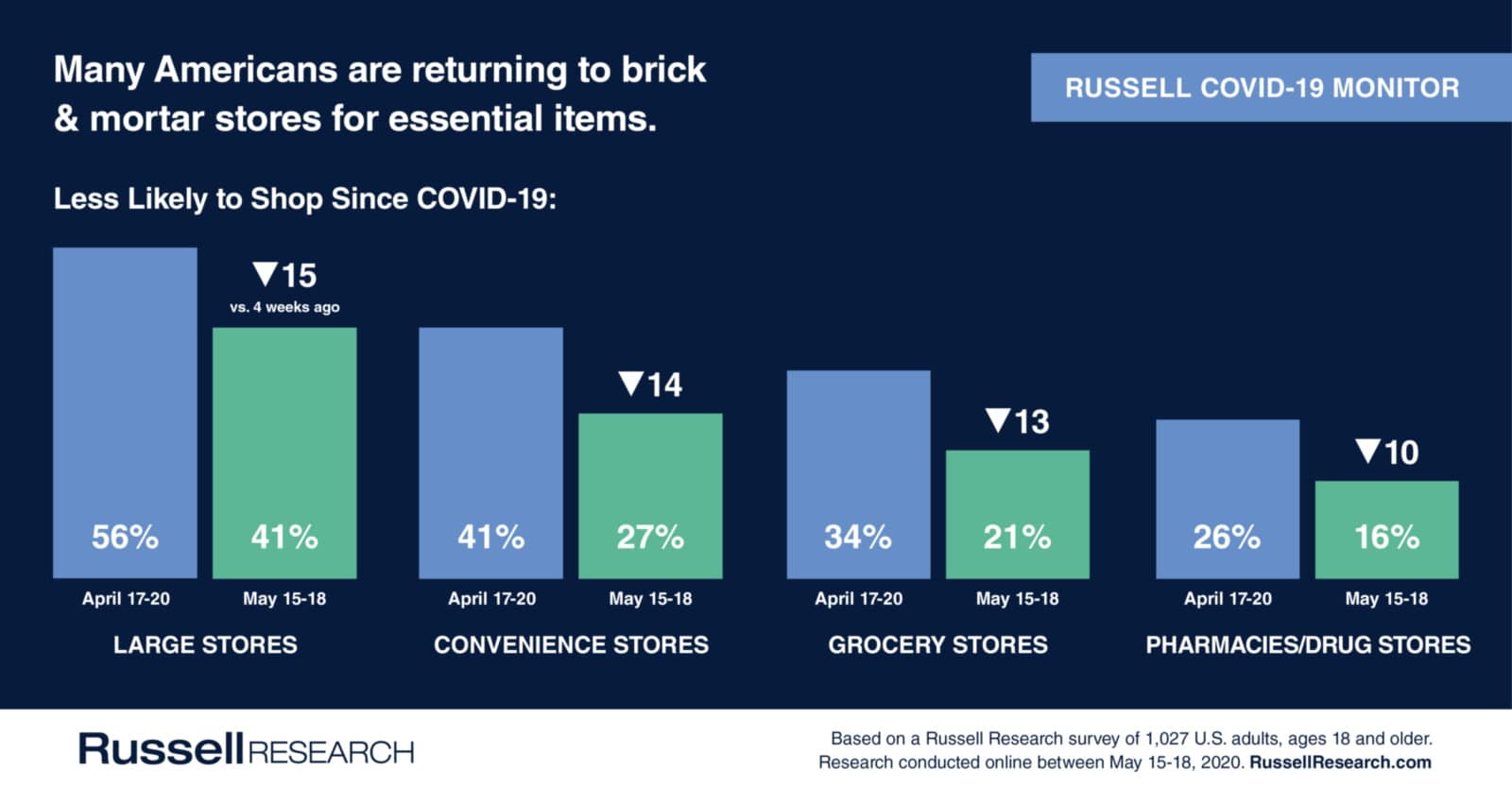

With Memorial Day approaching, more Americans are ready to resume both essential and non-essential activities. When compared to a month ago, there are significant decreases in the percentage of Americans who are currently less likely to dine out, travel, and participate in entertainment-based activities.

Even with these dramatic shifts, it’s important to note that we are nowhere close to pre-pandemic levels of participation. More than half of Americans are still less likely to do these non-essential activities.

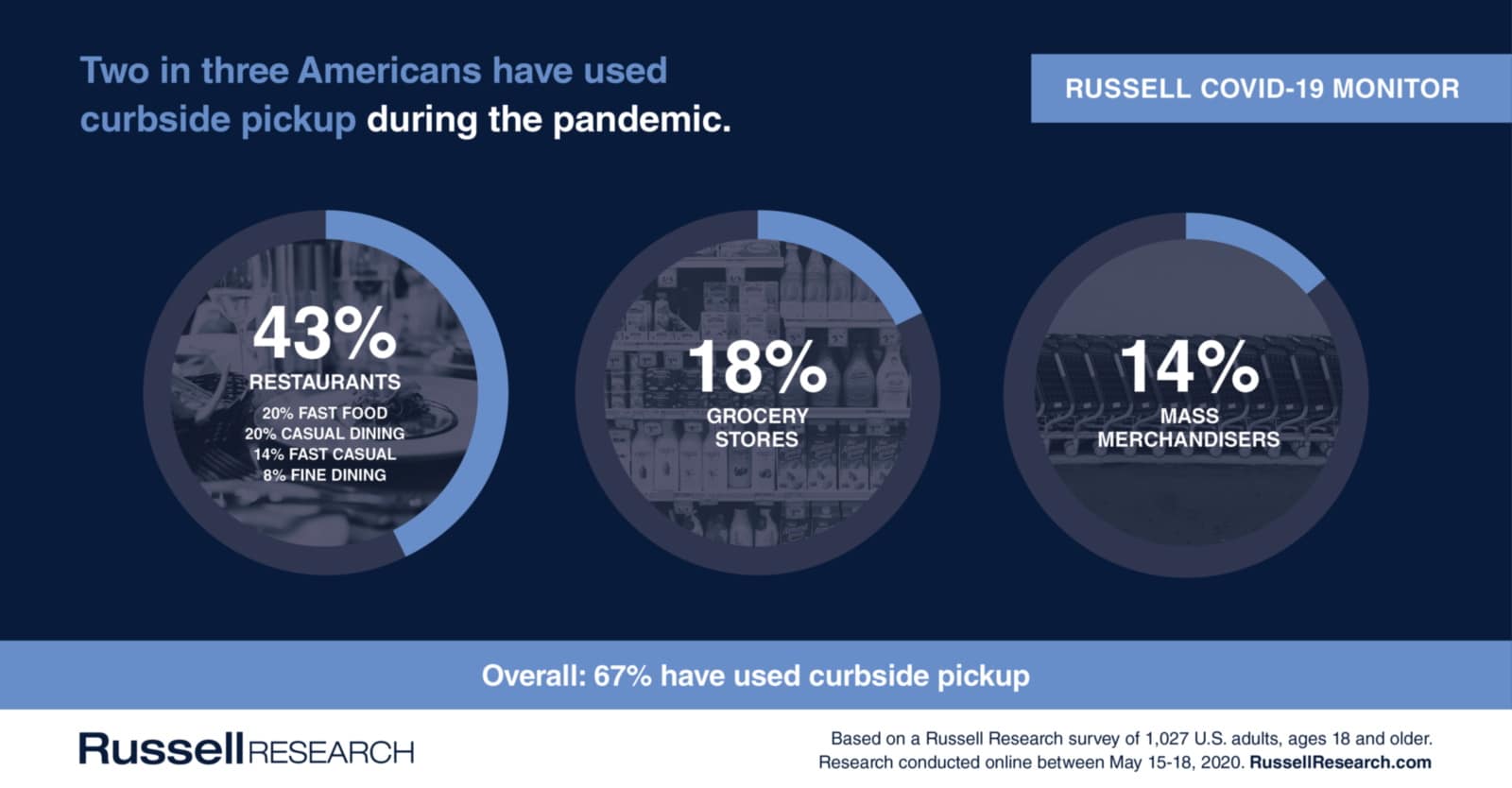

As stores and restaurants begin to reopen in advance of Memorial Day weekend, we took a look at curbside pickup this week. This has been a common practice for restaurants, retailers, and other businesses to generate sales over the past two months.

Curbside pickup has become a staple of consumer behavior. Two in three Americans have used curbside pickup since the start of the pandemic and three-quarters are open to using it moving forward.

Russell Research has interviewed over 11,000 Americans in the past eleven weeks about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes.

Below are our key findings from May 15-18, 2020. Russell Research has tabulated data available for all 11,000+ interviews with several additional questions asked. Please email [email protected] for more information.

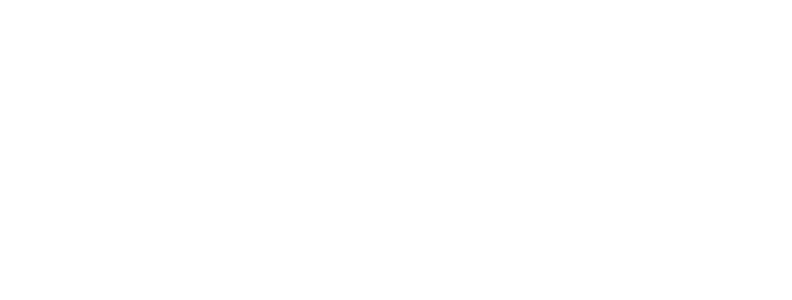

Views of the Current Situation

America remains concerned about COVID-19. Between May 15-18, 88% of Americans indicated they are concerned about coronavirus, compared to 86% from one week prior.

There continues to be no consensus on the trajectory of COVID-19 in the country. 42% of Americans feel that the current situation is getting better, compared to 40% last week. 29% believe the situation is getting worse, compared to 31% last week.

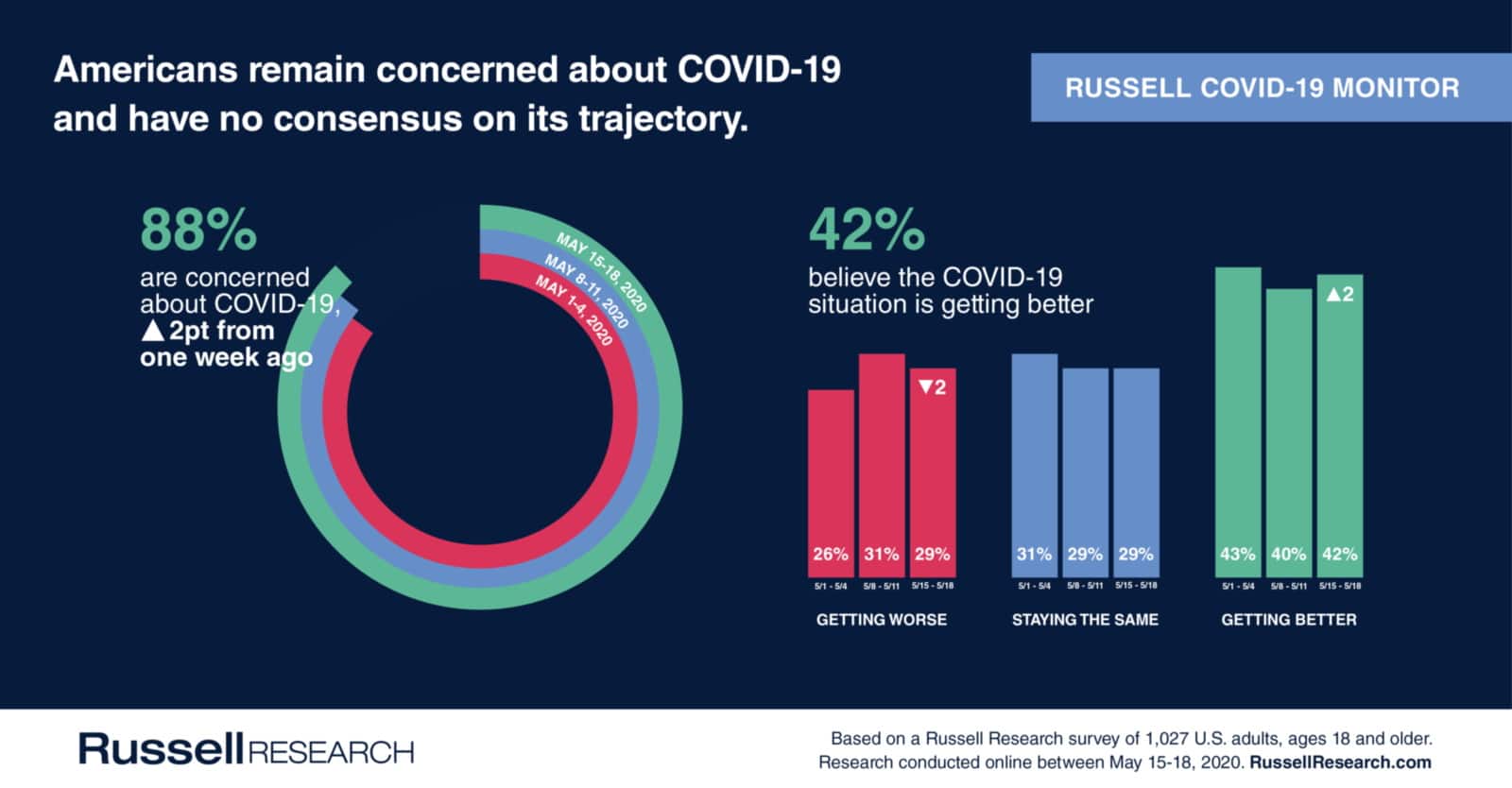

Impact on Behavior

The return to shopping in-person for essential items continued this week. Compared to four weeks ago (April 17-20), there have been large decreases in the percentage of Americans avoiding these shopping trips.

- 41% of Americans are currently less likely to go to a large store (-4 percentage points vs. last week, -15 points vs. four weeks ago)

- 27% are currently less likely to go to the convenience store (-2 one week, -14 four weeks)

- 21% are currently less likely to go to the grocery store (-3 one week, -13 four weeks)

- 16% are currently less likely to go to a pharmacy/drug store (-2 one week, -10 four weeks)

There have been significant decreases in the percentage of Americans avoiding essential activities, compared to both one and four weeks ago. However a majority of Americans remain less likely to participate in most of these activities.

Dining

- 61% are less likely to dine at a sit-down restaurant (-7 vs. last week, -15 four weeks)

- 54% are less likely to go to a fast casual restaurant (-6 one week, -14 four weeks)

- 54% are less likely to go to a fast food restaurant (-5 one week, -13 four weeks)

Entertainment & Shopping

- 65% of Americans are less likely to go to the movies (-6 vs. last week, -9 vs. four weeks ago)

- 62% are less likely to go to a shopping mall (-7 one week, -13 four weeks)

- 58% are less likely to go to a casino (-5 one week, -6 four weeks)

Travel & Transportation

- 63% are less likely to fly on an airplane (-5 vs. last week, -9 four weeks)

- 59% are less likely to stay at a hotel (-3 one week, -7 four weeks)

- 58% are less likely to use public transportation (-3 one week, -5 four weeks)

- 48% are less likely to use ride-sharing services (-6 one week, -11 four weeks)

Curbside Pickup

Two-thirds of Americans have used curbside pickup during the pandemic.

- 67% of Americans have used curbside pickup since the start of the pandemic.

- 43% have used curbside pickup at restaurants

- 20% have used curbside pickup at fast food restaurants

- 20% have used curbside pickup at casual dining restaurants

- 14% have used curbside pickup at fast casual restaurants

- 8% have used curbside pickup at fine dining restaurants

- 18% have used curbside pickup at grocery stores

- 14% have used curbside pickup at mass merchandisers

- 11% have used curbside pickup at pharmacies/drug stores

Three in four Americans are open to using curbside pickup in the future though it will be used by a relatively small percentage of shoppers in most retail categories.

- 76% of Americans are open to using curbside pickup in the future.

- 54% are open to using curbside pickup at restaurants

- 33% are open to using curbside pickup at fast food restaurants

- 33% are open to using curbside pickup at fast casual restaurants

- 32% are open to using curbside pickup at casual dining restaurants

- 16% are open to using curbside pickup at fine dining restaurants

- 31% are open to using curbside pickup at grocery stores

- 28% are open to using curbside pickup at mass merchandisers

- 26% are open to using curbside pickup at pharmacies/drug stores

- 22% are open to using curbside pickup at home improvement stores

- 19% are open to using curbside pickup at coffee shops / cafés

- 18% are open to using curbside pickup at warehouse stores

- 17% are open to using curbside pickup at electronics stores