COVID-19 & Its Impact on Everyday Life: November 6-9, 2020

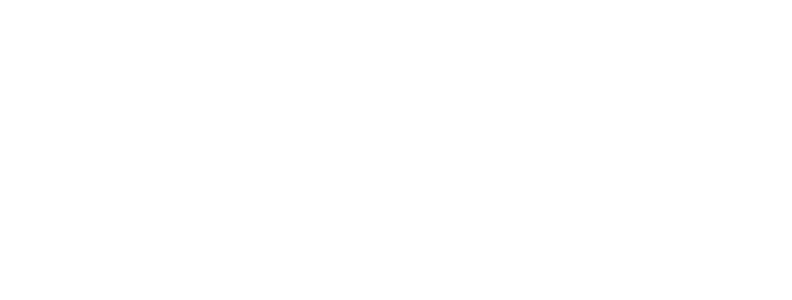

For the third time since March, there is a sustained increase in the percentage of Americans who believe the pandemic is moving in a negative direction. 55% of Americans now believe the pandemic trajectory is getting worse, compared to 43% one month ago (October 9-12). This percentage has increased for four consecutive waves.

85% of Americans are concerned about COVID-19, compared to 84% one month ago. This topline percentage of Americans who indicate concern has been very steady over time, however the percentage with the strongest degree of concern (“very concerned”) has been increasing, with 52% of Americans now very concerned (vs. 48% one month ago).

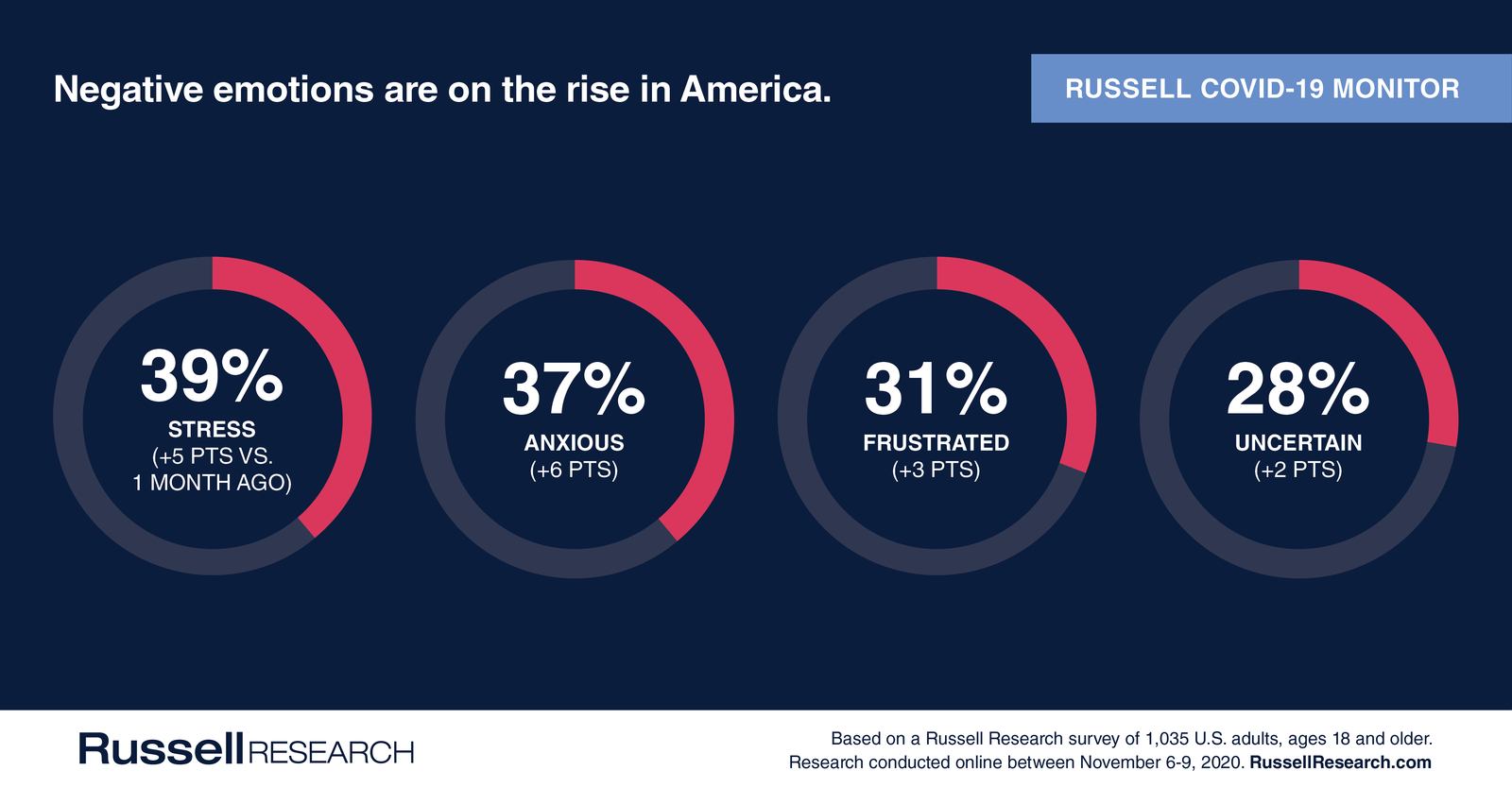

This resulted in an increase in negative emotions – 76% of Americans experienced 1 or more negative emotions in the past week, compared to 71% who reported the same in October. Stress (39%) and anxiety (37%) are the most common negative emotions.

This current wave of the pandemic comes as we enter the holiday season, which introduces several situations where people are more likely to congregate indoors:

- Holiday Travel / Get Togethers

- Holiday Shopping

- Climate-Forced Transition to Indoor Dining

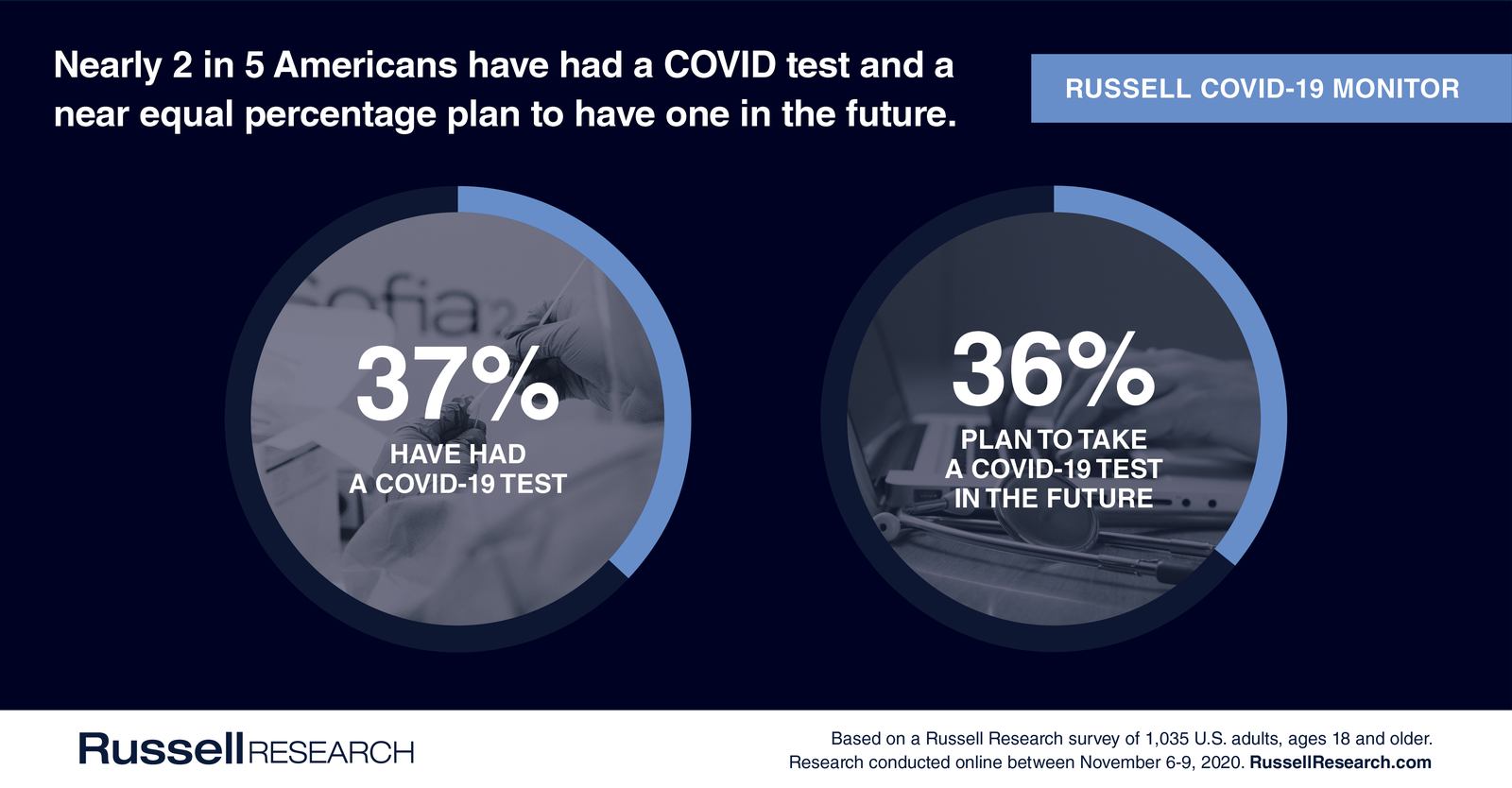

Even with the current pandemic, 52% of Americans plan to spend Thanksgiving with people outside of their household. Most of these Americans plan to take one or more precautions, with limiting party size (40%), remaining as socially distanced as possible (38%), and wearing masks when not eating/drinking the most common.

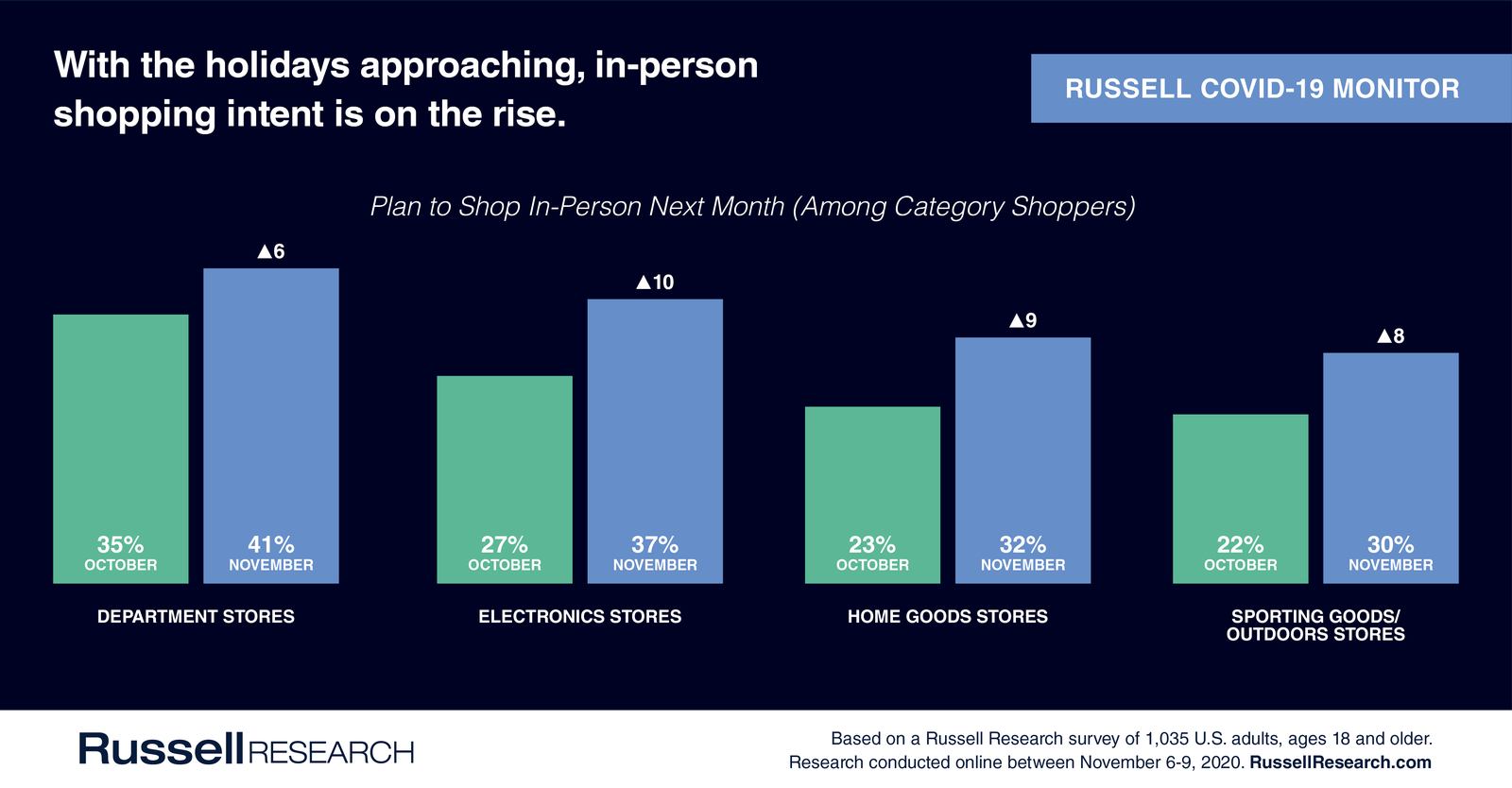

With the holidays approaching, more Americans intend to shop in-person the next month. In particular, there are large increases in the percentage of category shoppers who intend to shop at electronics (37% vs. 27% one month ago), home goods (32% vs. 23%), and sporting goods (30% vs. 22%) stores in November / early December. These are all popular gift categories.

The transition to colder weather is not ushering in a rise of in-person diners. Aside from an increase in consideration of visiting coffee shops/cafés in-person (38% vs. 33% one month ago), visitation intent to all restaurant categories was consistent with October.

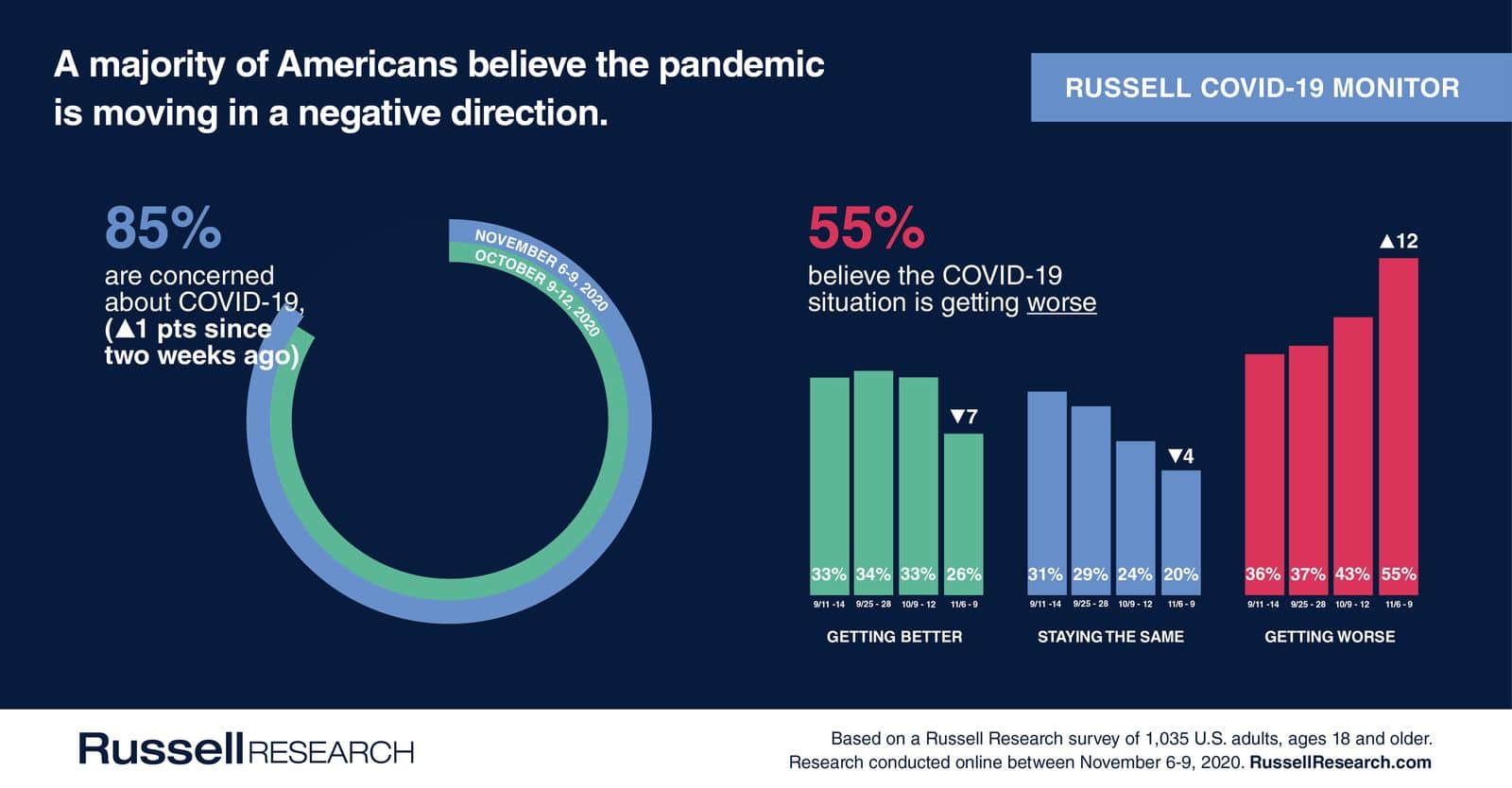

Finally, we asked about COVID-19 testing this wave. 37% of Americans have had a COVID-19 test in the past and 36% plan to be tested in the future (note: this wave occurred just prior to the worst week of the pandemic in terms of new cases).

Russell Research has interviewed over 23,000 Americans over the past 8 months about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will continue to evolve in the coming waves as the situation changes. The next wave is slated for December 4 – 7, 2020.

Below are our key findings from November 6-9, 2020. Russell Research has tabulated data available for all 23,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Views of the Current Situation

America continues to be concerned about COVID-19. Between November 6-9, 85% of Americans indicated they are concerned about coronavirus, near equal to the 84% seen in October.

However, 52% of Americans are now very concerned, up from 48% last month, and the first time since August it has exceeded 50%.

The pandemic trajectory is trending increasingly negative. 55% of Americans currently believe that the situation is getting worse, up significantly from 43% in October. This is the highest “negative” percentage since late July.

Only one in four Americans now believe the pandemic is getting better (26% vs. 33% in October).

Comparatively, three in ten Americans (31%) indicate that they’re paying more attention to the pandemic compared to one month ago, up from 27% in October. Only 14% are paying less attention (vs. 15% in October).

COVID-19 Testing

Nearly two in five Americans have had a COVID-19 Test.

- 37% of Americans have previously taken a test for COVID-19.

- 36% of Americans plan to take a COVID-19 test in the future

Thanksgiving Travel

A majority of Americans will spend Thanksgiving with people outside their household. A range of precautions will be taken to prevent the spread of COVID-19.

- 52% of Americans indicate they plan to spend Thanksgiving with other family members and/or friends who do not currently live in their home.

- Among the 52% who plan to send Thanksgiving with people outside their household:

- 40% will limit the number of guests to less than 10

- 38% will remain socially distanced as much as possible

- 28% will wear masks when not eating or drinking

- 25% will shorten the duration of the celebration

- 18% will keep windows/doors open

- 17% will quarantine prior to the holiday

- 14% will have a COVID-19 test beforehand

Emotion

There has been a significant increase in the percentage of Americans who experienced a negative emotion in the past week.

- 76% of Americans experienced a negative emotion in the past week, compared to 71% who reported a negative emotion a month ago.

- Many of the most widely reported negative emotions increased compared to October.

- 39% of Americans experienced stress during the past week (+5 percentage points vs. one month ago)

- 37% were anxious during the past week (+6)

- 31% were frustrated during the past week (+3)

- 28% felt uncertain during the past week (+2)

- 26% were overwhelmed during the past week (+2)

- Positive emotions decreased during this same timeframe (61% vs. 65% one month ago).

Impact on Behavior

There have been no major changes for in-person shopping consideration at essential item destinations.

Essential Item Destinations

- 84% of grocery shoppers intend to shop at a grocery store in the next month (+3 percentage points vs. one month ago)

- 68% of category shoppers intend to shop at a mass merchandiser in the next month (no change)

- 62% of category shoppers intend to shop at a pharmacy or drug store in the next month (+2)

- 54% of category shoppers intend to shop at a dollar store in the next month (+1)

- 53% of category shoppers intend to shop at a convenience store in the next month (+2)

- 46% of category shoppers intend to shop at a warehouse store in the next month (no change)

There has been a directional increase in consideration of visiting coffee shops/cafés in-person.

Food & Drink

- 50% of category users intend to dine at a fast food restaurant in the next month (+1 vs. one month ago)

- 40% of category users intend to dine at a fast casual restaurant in the next month (-1)

- 38% of category users intend to go to a coffee shop or café in the next month (+5)

- 35% of category users intend to dine at a casual dining restaurant in the next month (+3)

- 28% of category users intend to dine at a fine dining restaurant in the next month (+1)

With the holidays approaching, there have been increases for in-store shopping consideration at nearly all specialty formats, with the largest increases for electronics, home goods, and sporting goods retailers.

Clothing & Specialty Retail

- 48% of category shoppers intend to shop at a home improvement store in the next month (+4 vs. one month ago)

- 44% of category shoppers intend to shop at a clothing store in the next month (+4)

- 41% of category shoppers intend to shop at a department store in the next month (+6)

- 37% of category shoppers intend to shop at a pet store in the next month (-2)

- 37% of category shoppers intend to shop at an electronics store in the next month (+10)

- 32% of category shoppers intend to shop at a home goods store in the next month (+9)

- 30% of category shoppers intend to shop at an auto parts store in the next month (+1)

- 30% of category shoppers intend to shop at a sporting goods or outdoors store in the next month (+8)

- 28% of category shoppers intend to shop at a shoe store in the next month (+2)