COVID-19 & Its Impact on Everyday Life: May 22 – 25, 2020

Most Americans continue to be concerned with COVID-19. The country remains divided on their perception of the pandemic’s trajectory. There hasn’t been any meaningful movement on either measure in over a month.

All 50 states have now reopened to some degree. Several national retailers recently announced planned store openings across the country in the coming weeks. This week we asked Americans about their intent to visit and enter various types of brick and mortar locations.

Within the next month, a majority of Americans plan to shop in-person at retail locations that provide essential items. However less than two in five will enter a specialty retailer or dine at various restaurant formats in the next month (among shoppers/diners of each respective category). We will track these planned behaviors moving forward to help determine when economic recovery may accelerate.

The emotional state of America is slowly improving. The percentage of Americans who experiencing a positive emotion during the past week reached at an all-time high since the start of the pandemic. And although more prevalent, the percentage experiencing a negative emotion is at its lowest level to date.

Russell Research has interviewed over 12,000 Americans in the past twelve weeks about their coronavirus concerns and its impact on everyday behavior. Our COVID-19 Monitor will evolve in the coming weeks as the situation changes.

Below are our key findings from May 22-25, 2020. Russell Research has tabulated data available for all 12,000+ interviews with several additional questions asked in the survey. Please email [email protected] for more information.

Note About the COVID-19 Monitor: As American reopens and the curve flattens in more areas, we’ve seen movement in key metrics occurring at a more gradual pace over the past 6 weeks. As a result, the Russell COVID-19 Monitor will now be fielding every other week, with the next wave slated for June 5-8, 2020.

Views of the Current Situation

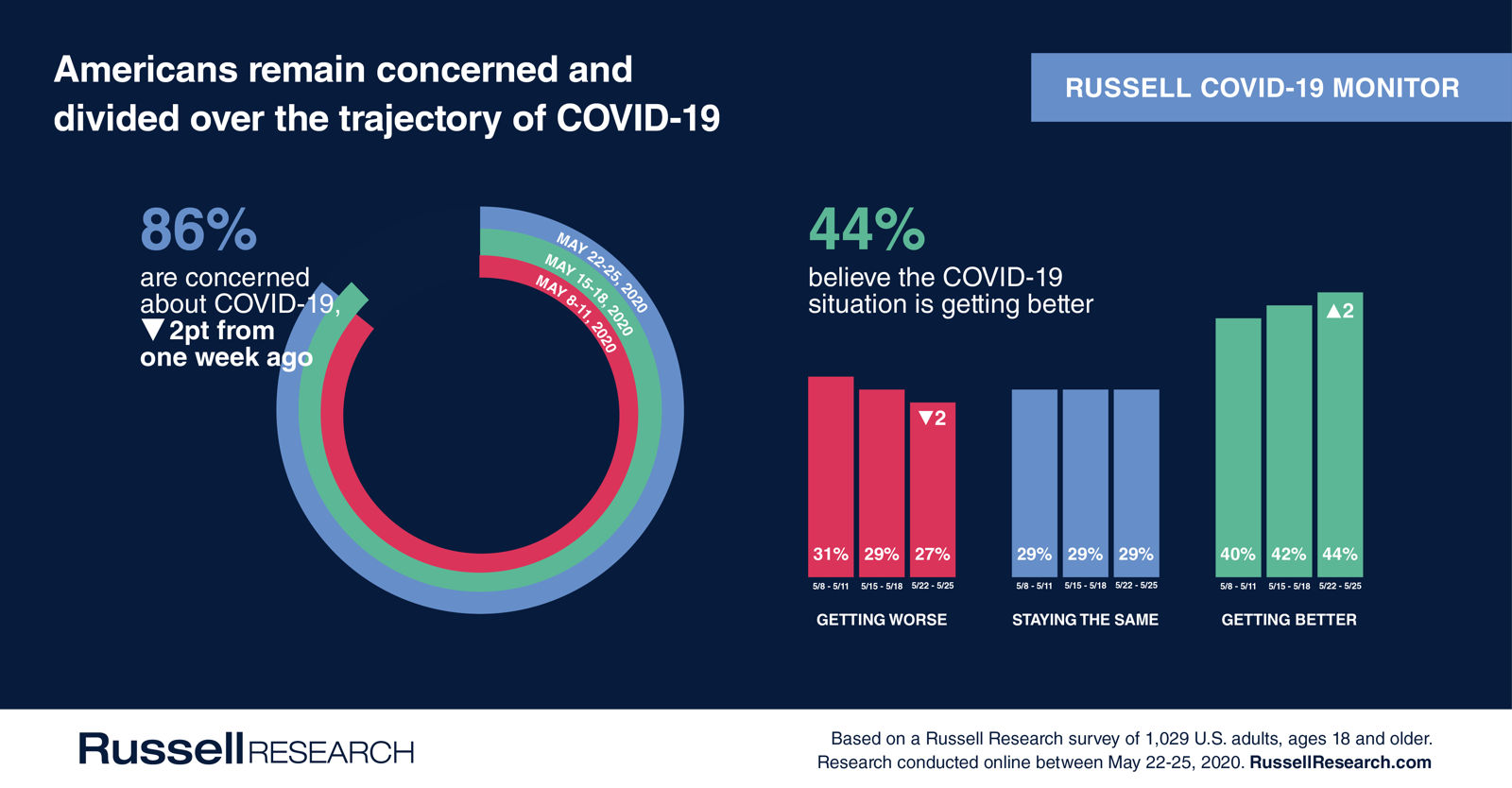

America remains concerned about COVID-19. Between May 22-25, 86% of Americans indicated they are concerned about coronavirus, compared to 88% from one week prior.

Feelings toward the trajectory of COVID-19 have been consistent over the past six weeks. 44% of Americans feel that the current situation is getting better, compared to 42% last week. 27% believe the situation is getting worse, compared to 29% last week. These percentages have held mostly steady since mid-April (40% better / 32% worse on April 17-20).

Impact on Behavior

Americans continue to slowly return to shopping in-person for essential items. The current differences are significant when compared to four weeks ago (April 24-27).

- 36% of Americans are currently less likely to go to a large store (-5 percentage points vs. last week, -13 points vs. four weeks ago)

- 25% are currently less likely to go to the convenience store (-2 one week, -8 four weeks)

- 20% are currently less likely to go to the grocery store (-1 one week, -6 four weeks)

- 13% are currently less likely to go to a pharmacy/drug store (-3 one week, -7 four weeks)

Reopening America

Aside for trips for essential items, less than one-half of Americans would consider physically entering a range of other brick & mortar establishments over the next month.

Essential Item Destinations

- 75% of grocery shoppers intend to shop at a grocery store in the next month

- 57% of category shoppers intend to shop at a mass merchandiser in the next month

- 53% of category shoppers intend to shop at a pharmacy or drug store in the next month

- 47% of category shoppers intend to shop at a warehouse store in the next month

- 40% of category shoppers intend to shop at a dollar store in the next month

Food & Drink

- 39% of category users intend to dine at a fast food restaurant in the next month

- 35% of category users intend to dine at a fast casual restaurant in the next month

- 28% of category users intend to go to a coffee shop or café in the next month

- 26% of category users intend to dine at a casual dining restaurant in the next month

- 18% of category users intend to dine at a fine dining restaurant in the next month

Clothing & Specialty Retail

- 39% of category shoppers intend to shop at a home improvement store in the next month

- 28% of category shoppers intend to shop at a clothing store in the next month

- 26% of category shoppers intend to shop at a pet store in the next month

- 25% of category shoppers intend to shop at a department store in the next month

- 22% of category shoppers intend to shop at an electronics store in the next month

- 22% of category shoppers intend to shop at a sporting goods or outdoors store in the next month

- 20% of category shoppers intend to shop at a home goods store in the next month

- 19% of category shoppers intend to shop at a shoe store in the next month

- 15% of category shoppers intend to shop at an auto parts store in the next month

Long-Term Behavior Change

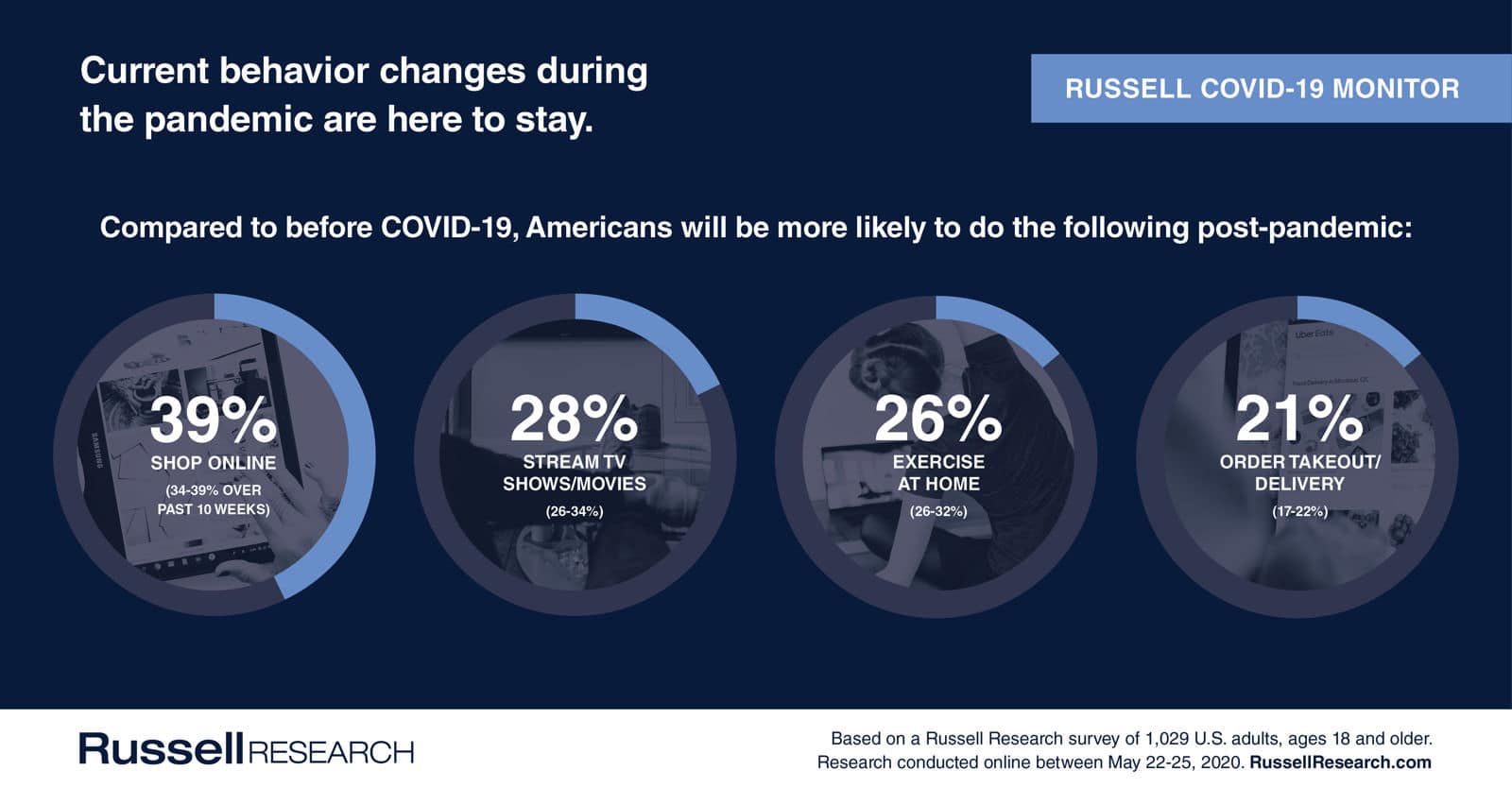

Over the past 10 weeks, there has been virtually no changes in the percentage of Americans who indicate they will continue certain current behaviors post-coronavirus.

- 39% of Americans indicate they will be more likely to shop online post-coronavirus in comparison to before the pandemic (34% – 39% over the past 10 weeks)

- 28% will be more likely to stream TV shows or movies in comparison to before the pandemic (26% – 34% over the past 10 weeks)

- 26% will be more likely to exercise at home in comparison to before the pandemic (26% – 32% over the past 10 weeks)

- 21% will be more likely to order takeout or delivery in comparison to before the pandemic (17% – 22% over the past 10 weeks)

- 11% will be more likely to have groceries delivered in comparison to before the pandemic (9% – 14% over the past 10 weeks)

Emotions

The emotional state of Americans is gradually becoming more positive. However negative emotions continue to be more common.

- 67% of Americans report feeling 1 or more positive emotions in the past week (+4 percentage points vs. 1 week ago, +7 vs. 4 weeks ago)

- 24% report feeling happy (+1 vs. 1 week ago, +6 vs. 4 weeks ago)

- 21% report feeling optimistic (+3 vs. 1 week ago, +3 vs. 4 weeks ago)

- 21% report feeling responsible (+2 vs. 1 week ago, +5 vs. 4 weeks ago)

- 20% report feeling satisfied (no change vs. 1 week ago, +6 vs. 4 weeks ago)

- 17% report feeling motivated in the past week (+3 vs. 1 week ago, +4 vs. 4 weeks ago)

- 74% of Americans report feeling 1 or more negative emotions in the past week (-1 percentage points vs. 1 week ago, -5 vs. 4 weeks ago)

- 32% report feeling cautious in the past week (+1 vs. 1 week ago, -4 vs. 4 weeks ago)

- 29% report feeling stressed (-2 vs. 1 week ago, -3 vs. 4 weeks ago)

- 29% report feeling anxious (+1 vs. 1 week ago, -5 vs. 4 weeks ago)

- 27% report feeling frustrated (no change vs. 1 week ago, -2 vs. 4 weeks ago)

- 26% report feeling uncertain (-1 vs. 1 week ago, -6 vs. 4 weeks ago)